In this blog, we will cover and discuss the gift of equity on home purchase mortgage guidelines. Many people want to keep the family home in the family. When the parents retire and downsize, mom and dad want to sell the home to one of their children at a discount. What does the gift of equity on home purchase mean? Alex Carlucci of Gustan Cho Associates explains what gift of equity on home purchase means:

A gift of equity in the context of a home purchase occurs when a homeowner sells their property to a buyer with whom they share a close relationship, typically a family member or a dear friend. This involves the seller offering the home at a discounted price, meaning the property is sold below its market or appraised value. By selling the home at a value lower than its market worth, the buyer acquires immediate equity in the property upon purchase.

There are cases where a relative decides to sell their home to a relative. The down payment from the seller is gifted to the home buyer’s relative. Therefore, instead of giving the homebuyer cash for a gift, the seller gifts the equity in their home to the home buyer. In the following paragraphs, we will cover gift of equity on home purchase.

Table of contents "Click Here" Toggle

Often, an older parent may express the desire to transfer the family home to their son or daughter at a price significantly below the market or appraised value. In instances like these, the seller is selling their property to a son, daughter, or relative at a value below the market rate. Dale Elenteny, from Gustan Cho Associates, elucidates on individuals eligible to provide a gift of equity in a home purchase:

Home sellers who can give a gift of equity on home purchase are eligible to offer a gift of equity on home purchase to a family member, including legal siblings, parents, grandparents, legal guardians, and/or their spouses.

Receiving a gift of equity when purchasing a home can assist the buyer in avoiding the need to provide the entire or a portion of the down payment, thereby easing constraints on the home purchase. Lenders typically mandate a formalized gift of equity letter, which must be signed and include specific language. Prequalify for a mortgage in just five minutes.

Typically, in purchase transactions involving a gift of equity, the seller disposes of the property to a buyer who is a relative at a discounted rate. The amount below the market price or appraised value can serve as a gift of equity for the homebuyer, thereby restricting the down payment required from them.

The loan officer will instruct the seller and buyer on how to structure the gift of equity real estate purchase contract and will structure the home purchase and mortgage process accordingly.

Obtaining a gift of equity for a home purchase is a straightforward process, akin to a standard home buying procedure. The mortgage company’s loan officer will collaborate with the seller, borrowers, and title company to facilitate the gift of equity on the home purchase.

If there is a sufficient gift of equity, the home buyer will not be obligated to make a down payment. As previously mentioned, the seller must complete a gift of equity letter using the appropriate language provided by the mortgage lender. This letter or form explicitly declares that the seller is gifting equity to the borrower, and this gift is non-repayable under any circumstances. Additionally, the seller may choose to cover the closing costs for the home buyer. In cases where there is adequate equity in the home purchase, the buyer is not required to contribute any funds and must still qualify for a residential mortgage loan.

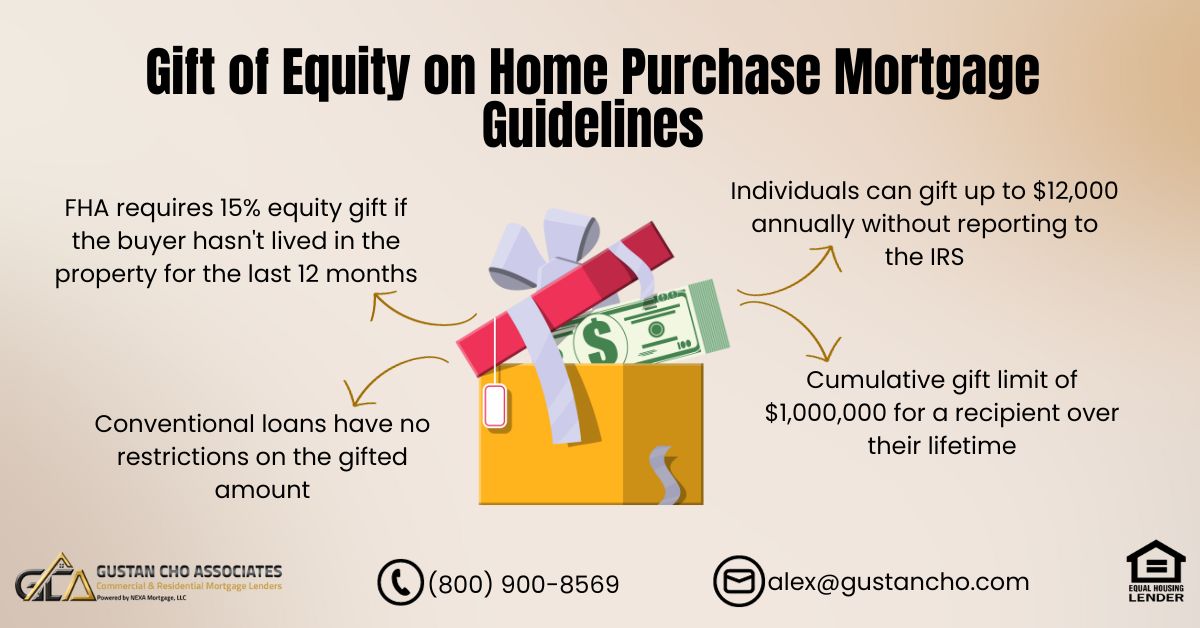

The guidelines for HUD’s Gift of Equity on home purchases specify that if the buyer has not resided in the property being purchased through a gift of equity in the last 12 months, the seller is required to gift 15% equity. However, if the buyer has lived in the property for the past six months and is currently residing there, the seller can provide a gift of 3.5% for the down payment. In the case of conventional loans, there is no restriction on the amount that can be gifted, and it can be done by a relative regardless of whether the buyer has lived in the property before purchasing it. Talk for a mortgage loan by fill up quote form in just five minutes.

Home Buyers and Sellers participating in the gift of equity home purchase transactions can have potential tax consequences. Both buyers and sellers should consult with their accountants or tax advisors concerning how the gift of equity transactions can affect their tax liabilities

It’s important to note that gifts of equity may have potential tax implications. Homebuyers and sellers are advised to engage in a conversation with a tax advisor or a certified accountant to grasp how these implications can affect their circumstances. Depending on factors such as tax brackets, the number of dependents, and marital status, there may be strategies available to mitigate the risk of substantial gift taxes or taxable gift taxes, offering a potential avenue to avoid such payments.

Gifts from family members are subject to certain allowances. For instance, an individual is authorized to bestow a gift to another individual amounting to $12,000 annually without having to report it to the Internal Revenue Service. There exists a cumulative gift limit of $1,000,000 for a recipient over their lifetime. In cases where a recipient is receiving gifts from both parents, each parent is entitled to gift the child $12,000, resulting in a combined total of $24,000 for that specific child. Any excess gift beyond this limit can be carried over to the subsequent year until the child reaches a maximum lifetime gift amount of $1,000,000. Prequalify for a mortgage loan in just five minutes.

The U.S. Department Of Housing And Urban Development (HUD) which is the parent of The Federal Housing Administration (FHA) allows 100% gift of equity from the donor to a relative. However, on conventional mortgage loan programs, the mortgage lender wants to see that the person receiving the gift has 5% of their own funds for the down payment of the gift of equity home purchase.

Gustan Cho Associates specializes in effectively structuring gift of equity in home purchase transactions. As licensed mortgage brokers operating in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands, Gustan Cho Associates has garnered a nationwide reputation for successfully securing mortgage loans that may pose challenges for other lenders.

Please contact Gustan Cho Associates for more information on structuring a gift of equity mortgage loan at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The Team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays. Prequalify for a mortgage in just five minutes.

This blog about the Gift of Equity on Home Purchase Mortgage Guidelines was updated on February 5, 2024.

Alex Carlucci is an experienced private mortgage banker with Gustan Cho Associates. He has been in the mortgage industry for 20 years, and prides himself of his excellent customer service and communication. Alex has extraordinary customer service throughout the whole loan process, and works very closely with each and every client to give them the best experience. Alex is very experienced and knowledgeable in Conventional, FHA, VA, and Jumbo loans. He is also always up to date with all the constant changes in guidelines in the mortgage industry. Alex credits Finance of America's support team as a foundation for his success. He has built a support team that has earned him an unmatched reputation for accessibility, communication and service to all parties involved in each and every loan.

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on RedditThis guide…

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on Reddit This…

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on RedditThis article…

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on Reddit This…

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on RedditThis article…

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on RedditThis ARTICLE…

GoodBased on 65 reviewsTrustindex verifies that the original source of the review is Google.Sapna Sharma2024-07-04I am working with Gustan Cho Associates and all the staff and Gus are so cooperatives. Gus is a motivational person and he always motivate or praise about my work. Really so happy working with Gustan Cho Associates Family.Trustindex verifies that the original source of the review is Google.James Strebel2024-04-06Very professionalTrustindex verifies that the original source of the review is Google.Bill Burg2024-04-06Man it’s been great working with Gus and his amazing team. Their professionalism and attention to detail is second to none. I’ve never met anyone with more knowledge and skill at finding ways to help people into a home than him.Trustindex verifies that the original source of the review is Google.Rhonda Smith2024-02-23Amazing placeTrustindex verifies that the original source of the review is Google.brent norkus2024-02-23Working with Gustan and his team has been an absolute pleasure. From start to finish, they have every client's best interest in mind to ensure they get the correct loan that fits their needs. Efficiency and accuracy are two words that describe my experience with Gus. Gus and his team over at Nexa are dominating the GAME! 5 stars is an understatement, and I would give ten stars if possible!Trustindex verifies that the original source of the review is Google.TCrumpCollinsParsonMcGinnis Frazier2024-02-22John and Angie are absolutely amazing! We had another lender and our loan fell through at the last minute. I called John and told him our issues and in 5 minutes he told me he could get it done. After 30 years of praying, moving and bankruptcy issues, these two got it done. It’s was fast and they answered all our questions. There are not enough words that could express how overwhelmed we are and how awesome they are. Do yourself a favor and call John, I promise you will thank me later. Please check out Gustan Cho’s videos. They are telling the truth and will walk thru fire with you. Thank you John and Angie! The Frazier’s.Trustindex verifies that the original source of the review is Google.Charlie G2024-02-16Gus is a great person, and a great loan officer with lots of experience and knowledge of many types of loans. Gus even takes calls after business hours unlike a lot of other companies. Gus has given me the best options available for a mortgage; he is honest and has integrity. I got to give Gus 5 stars due to he goes the extra mile to help you. Thanks Gus.Trustindex verifies that the original source of the review is Google.David Heckman2024-02-15John Strange and Angie Torres made this whole process seamless from start to finish. John would answer a text or call anytime and made sure to keep me updated the whole time. I would tell you that you are in good hands with these two!

Gustan Cho Associates are mortgage brokers licensed in 48 states including Washington DC, Puerto Rico, and the U.S Virgin Islands (Not licensed in NY and MA). The team at Gustan Cho Associates has a national reputation of being able to do mortgage loans other mortgage companies cannot do. Gustan Cho Associates dba of NEXA Mortgage has a lending partnerships with over 190 wholesale mortgage lenders with dozens of no overlay lending partners on government and conventional loans and countless non-QM and alternative lending partners. Over 80% of our clients are borrowers who could not qualify at other mortgage companies either due to a last-minute mortgage loan denial due to lender overlays or because the lender did not have the mortgage loan program suited for the borrower. At Gustan Cho Associates, we only market mortgage loan products that exists and are possible.